Mineral markets have tightened over the last few months and the outlook for Australian iron ore exports has improved, reports the Office of the Chief Economist in the December edition of the “Resources and Energy Quarterly”.

A key indicator: steel

As every 1,000 kilograms of steel requires 1,400 kilograms of iron to make, global steel production and consumption is a key indicator for Australian iron ore production and exports.

World steel consumption will likely be down by 2.2 per cent in 2020 because of COVID, the REQ says. However, steel consumption will likely rebound by 3.8 per cent in 2021 and 3.6 per cent in 2022.

There will likely be a similar trend in steel production. The key drivers are likely to be automotive production and construction activity. Steel markets around the world will, however, be uneven with growth in China, a recovery in India and South Korea, and difficulties in Europe, Brazil and Japan.

Iron ore

Total world trade volumes have risen from 1,555 million tonnes in 2019 to an estimated 1,647 million tonnes in 2020. Looking forward, growth to 1,783 million tonnes is forecast for 2021 with a further increase to 1,861 million tonnes in 2022.

Brazilian iron ore producer Vale continues to have problems with the structural stability of its dams and it is exposed to a range of legal / regulatory actions. Nonetheless, despite its difficulties, Vale’s shipments rose from 64 million tonnes in the June quarter to 82 million tonnes in the September quarter. Longer term, its Serra Sul project is expected to be complete by 2024, which will give the company access to more areas for further mining. A boost in volumes by 20 million tonnes a year is expected.

Meanwhile, in Canada, the Bloom Lake expansion is due to complete at the end of December 2020 and would double output to 15 million tonnes a year.

China is investing in the Simandou, Guinea project in an attempt to diversify supply. However, complex terrain and distance will likely put a project infrastructure price tag of about US$20 billion on the project. Production is not likely to occur for years… and, in fact, there has been little progress over the last 10 years.

Growing seaborne iron-ore volumes can be attributed to strong Chinese demand to make steel for construction for infrastructure (such as for bridges, road, rail or subways) and property. However, the REQ reports that Chinese demand is likely at its peak with a volume decline expected over the next 10 years.

Australian iron ore volumes are expected to grow from 858 million tonnes in 2019-20 to 906 million tonnes by 2021-22, the REQ says. To put that into a shipping context, 858 million tonnes of iron ore would fill about 4,516 capesize bulkers (assuming capesize capacity of 200,000 dwt and five per cent of that capacity is allocated to stores, fuel and other materials).

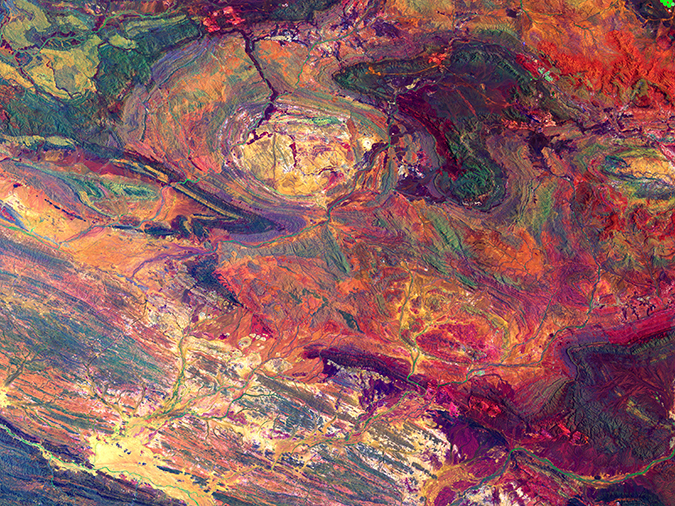

On the Australian-supply side, there is an expansion of mining in the Pilbara. A new mine, Paulsens East, is likely to open mid 2021 with an output of about six million tonnes over four years. Meanwhile, there has been a refurbishment of facilities at Port Hedland. Maintenance at facilities in Dampier is also expected to support export volumes. Output may further increase in the future as iron ore exploration, driven by high prices, has picked up in Australia in recent months.

Meanwhile, stronger prices – driven by Chinese demand and disruptions to Brazilian supply – is likely to push export values up to a peak of $123 billion in 2020-21.